Guide to Accounts Payable Turnover Ratio Formula & Examples

Some companies will only include the purchases that impact cost of goods sold (COGS) in their Total Purchases calculation, while others will include cash and credit card purchases. Both scenarios will skew the accounts payable turnover ratio calculation, making it appear the company’s ratio is higher than it actually is. Before you can understand how to calculate and use the accounts payable turnover ratio, you must first understand what the accounts payable turnover ratio is.

How to Automate Accounts Payable Efficiently with Cflow

The length of the accounting period you’re looking at matters a lot when you’re calculating your accounts payable turnover ratio, as do your industry and your cash flow management strategy. The accounts payable turnover ratio is an important indicator of a company’s ability to manage cash flow and its liquidity on a balance sheet. However, if calculated regularly, an increasing or decreasing accounts payable turnover ratio can let suppliers know if you’re paying your bills faster or slower than during previous periods. A lower accounts payable turnover ratio can indicate that a company is struggling to pay its short-term liabilities because of a lack of cash flow. This can indicate that a business may be in financial distress, making it more difficult to obtain favorable credit terms. It provides justification for approving favorable credit terms or customer payment plans.

Industry Benchmarking for AP Turnover Ratio

The AP turnover ratio is one of the best financial ratios for assessing a company’s ability to pay its trade credit accounts at the optimal point in time and manage cash flow. In corporate finance, you can add immense value by monitoring and analyzing the accounts payable turnover ratio. Transform the payables ratio into days payable outstanding (DPO) to see the results from a different viewpoint. Economic conditions, like interest rates or a recession, can impact a company’s payment practices. In a tight credit market, companies might delay payments to maintain liquidity, decreasing the turnover ratio.

Seasonal Businesses Impact

With Volopay you get a comprehensive consolidated dashboard that is capable of managing accounts payable process completely. Balance your cash inflows and outflows to get a better understanding should you choose xero over quickbooks of how to improve the AP turnover ratio. It can help you with finding a way to keep sufficient cash on hand that may be required to support the goals of the business.

Committed to delivering quality work and supporting team objectives with enthusiasm. Contact Cflow today to schedule a demo and discover the extensive benefits of AP automation for your business. For example, if you were a car manufacturer, you might look up Ford and discover it has a 5.20 payable turnover for the most recent quarter.

Example of the Accounts Payable Turnover Ratio

Use graphs to view the changes in trends as the economy and your business change. Generally, a higher AP turnover ratio and a lower AR turnover ratio are seen as favorable. High AP turnover could indicate an overly aggressive payment policy that might strain supplier relationships, while a low AR turnover could signal ineffective credit management. It’s important to consider industry benchmarks and other financial indicators for a holistic understanding.

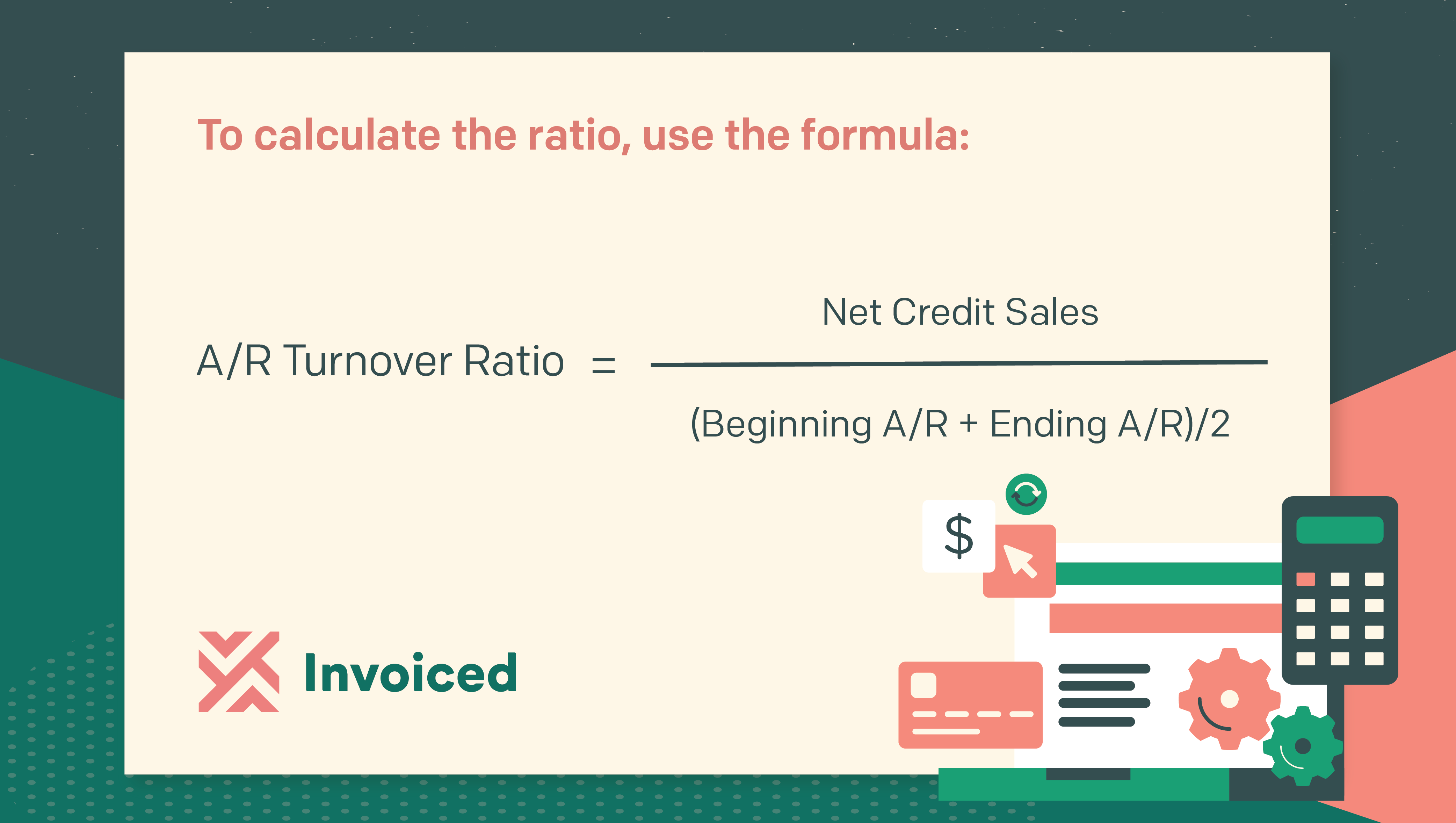

To calculate accounts payable turnover, take net credit purchases and divide it by the average accounts payable balance. In the case of our example, you would want to take steps to improve your accounts payable turnover ratio, either by paying your suppliers faster or by purchasing less on credit. But there is such a thing as having an accounts payable turnover ratio that is too high. If your business’s accounts payable turnover ratio is high and continues to increase with time, it could be an indication you are missing out on opportunities to reinvest in your business. The accounts payable turnover ratio measures only your accounts payable; other short-term debts — like credit card balances and short-term loans — are excluded from the calculation.

- Another important component to consider when calculating the Accounts Payable Turnover Ratio is the payment terms negotiated with suppliers.

- Dive in and discover how to elevate your resume to stand out in the accounts payable field.

- Typically, a higher ratio indicates better liquidity, suggesting efficiency in clearing dues to suppliers.

- Companies identify trends and spending patterns that help them uncover opportunities for additional cost savings and enhance efficiency.

- However, the investor may want to look at a succession of AP turnover ratios for Company B to determine in which direction they’ve been moving.

A company’s accounts payable turnover ratio is a key measure of back-office efficiency and financial health. You can automatically or manually compute the AP turnover ratio for the time period being measured and compare historical trends. The basic formula for the AP turnover ratio considers the total dollar amount of supplier purchases divided by the average accounts payable balance over a given period. The result is a figure representing how many times a company pays off its suppliers in that time frame. Both ratios provide valuable insights into a company’s financial health and, when used together, offer a more comprehensive view.

If your AP turnover for the same quarter is above 5.2, that would look better to creditors. However, it might also mean that your company pays its bills more quickly than you need to, tying up cash you could use in other ways. Your average AP balance is simply the average between your starting accounts payable balance and your ending accounts payable balance over a given time period. A decreasing turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods. Having full transparency into your company’s spending behavior can give you great insights into the areas where accounts payable turnover can be improved. Start by adding the accounts payable balance at the end of the chosen period with the accounts payable balance at the beginning of the period.

It reduces exceptions, prevents fraud, and ensures that every invoice is paid on time and working capital is optimized. Your AP turnover ratio is generally more important than DPO in making business decisions, but DPO provides additional information to paint a more complete picture of your accounts payable. Very few real-world companies will have such a high AP turnover ratio over that time frame because very few companies pay every bill the day after it comes in the door. By factoring in your average AP balance, not just your total payables, AP turnover measures whether you’re staying right on top of your payables or letting that total creep upward. If your business relies on maintaining a line of credit, lenders will provide more favorable terms with a higher ratio. But if the ratio is too high, some analysts might question whether your company is using its cash flow in the most strategic manner for business growth.

Measured over time, a decreasing figure for the AP turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods. Alternatively, a decreasing ratio could also mean the company has negotiated different payment arrangements with its suppliers. Optical Character Recognition (OCR) technology in AP automation software converts printed text into editable digital files which significantly improves accuracy and efficiency. This is especially beneficial for companies that handle large volumes of financial transactions. The technology also allows for quick digital searches making it easier to locate specific invoices. OCR streamlines the AP process with automatic data extraction and pre-populating key details with intelligent coding where changes are made to future invoices.