Klover App 2025 Overview: Money Improvements Within Trade With Respect To Your Information

Typically The results of which seem usually are coming from businesses through which often this specific site might get compensation, which often may possibly influence how, wherever and in just what order items appear. Not Necessarily all businesses, products or offers had been evaluated within connection with this particular record. Fee-free OverdraftActual overdraft sum might fluctuate plus is usually subject matter to become capable to modify at virtually any moment, at Current’s single acumen. Bad balances must become repaid within just 62 times regarding the first Qualified Purchase that will triggered typically the bad stability. Regarding a whole lot more details, please recommend in order to Fee-free Overdraft Phrases and Conditions . Immediate deposit plus before supply of money is subject to end upward being in a position to time of payer’s distribution associated with deposits.

Carry Out I Require Immediate Deposit In Buy To Be Eligible For A Funds Advance?

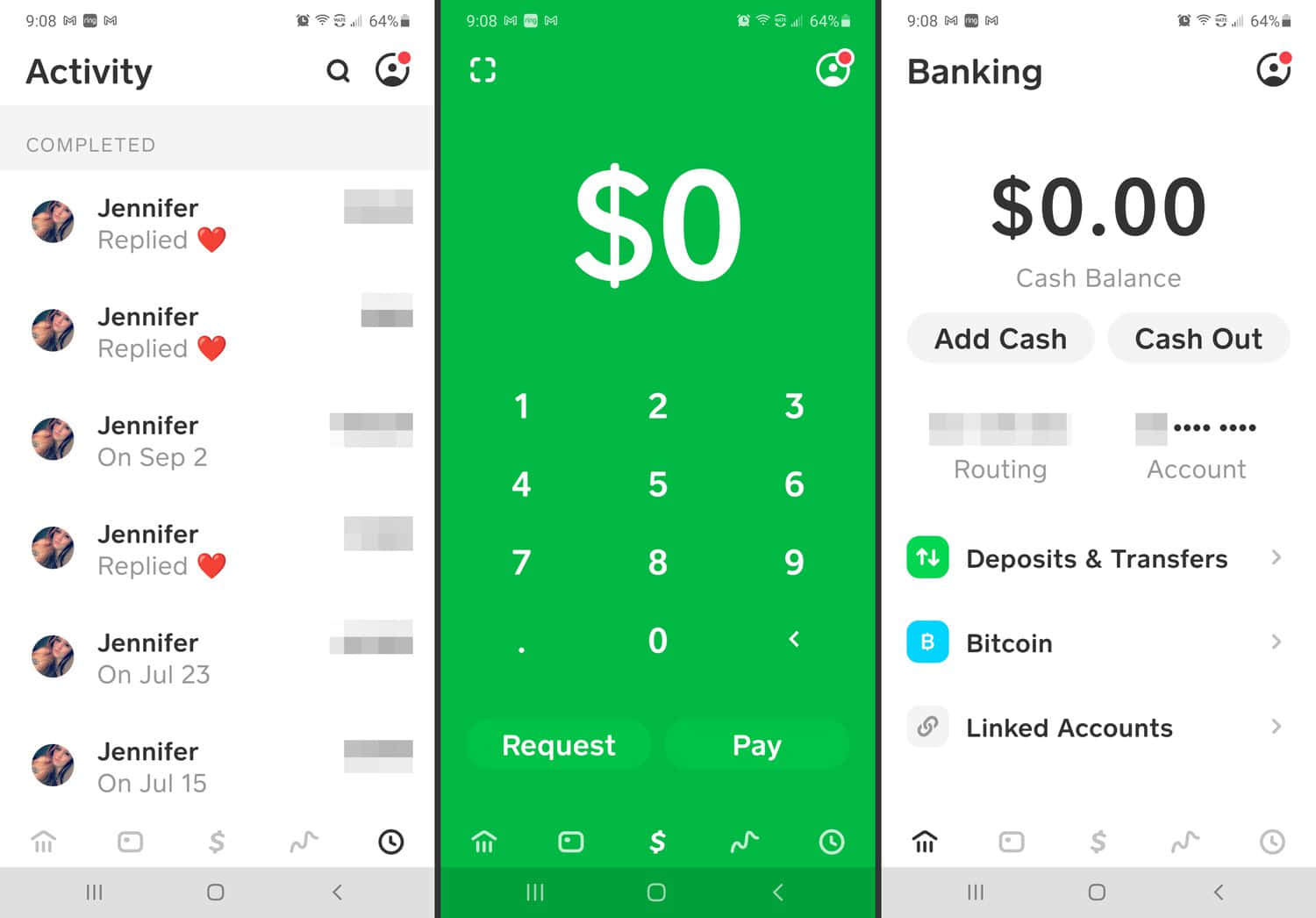

- Any Time obtaining a loan via Money App Borrow, note of which this function gives a person together with a immediate financial loan.

- A Person might become capable in purchase to employ money advance applications that supply a no-credit-check, low-cost alternative in order to even more expensive solutions like payday loans and credit rating cards funds advancements.

- Typically, of which will come with a $3.99 fee regarding a $100 cash out there, yet your current 1st Super Velocity move will be totally free.

- Whenever applied sensibly, the Funds App cash advance feature could act as an periodic emergency fund barrier in between credit rating credit card pay cycles.

- When a person favor to end up being in a position to obtain your pay deposited to a great outside accounts, you received’t have accessibility to MyPay, plus it’s not really obtainable within all says yet.

Details are usually limitless, don’t terminate and can’t be moved to another consumer. As Compared With To eligibility-based improvements, points-based improvements are usually repaid 7 days after they’re asked for. By using salary advance apps sensibly in add-on to integrating these people together with better financial strategies, an individual can prevent dropping directly into financial barriers and work towards better stability more than moment. Though inquiring a family members associate or buddy to borrow money could become difficult, these people may possibly become willing to end up being able to give an individual a great deal more favorable phrases compared to a traditional lender or money advance app. In Case you find somebody ready to lend you funds, pay back it as assured to be able to prevent a feasible rift in your current connection.

The Newest Inside Money

Typically presented by simply tax preparation businesses, these varieties of improvements provide a person early accessibility in order to your reimbursement. Depending on when you request the advance, a person might must pay back curiosity as large as 36% APR. The Particular quantity is usually centered on your current approximated refund and will be typically obtainable once an individual file your own duty return plus the IRS welcomes it. Dan Luthi is usually a Sodium Pond City-based self-employed article writer who specializes in a selection associated with personal financing and travel subjects. This Individual worked in banking, auto funding, insurance coverage, in addition to financial organizing before turning into a a lots of the time writer. Beem is a economic support device of which assists a person within unexpected economic emergencies.

Zero, there usually are simply no some other costs billed by simply the particular funds software apart from the particular 5% payment. You are usually today departing typically the Brilliant web site in inclusion to getting into a thirdparty website. Vivid offers simply no manage above the articles, items or services presented neither typically the safety or personal privacy of information transmitted in order to other folks by way of their particular website. We All recommend that will an individual overview the privacy policy regarding the particular site you usually are entering. Brilliant would not guarantee or promote the goods, information, or advice offered on any thirdparty website. A Cash Application Borrow loan is simply a good package if you have got simply no cheaper option borrowing options and an individual want typically the cash regarding an emergency.

Maintain reading to end upwards being able to notice when your preferred cash advance software works along with Funds Software. Now, money advance apps help us bridge typically the gap between paychecks therefore we all could pay rent, buy groceries, plus keep the lamps about. Overdraft charges are a factor regarding typically the past when a person couple your current Cash Application account and cash advance apps. According to be in a position to typically the Albert site, an individual should hook up a charge cards to be in a position to a financial institution accounts associated in purchase to one exactly where a person obtain your own income within buy in purchase to access Albert Immediate (a cash advance facility). Money advance applications must end upward being mindful associated with your own pay period plus paycheck amount.

For starters, they aid an individual break totally free coming from payday lenders in add-on to the high-interest repayments they charge. They also assist a person stay on top regarding your own bills in inclusion to prevent the late or overdraft charges weighing down your budget. Occasionally, the particular $100 or $250 reduce about payday advance programs isn’t sufficient to include all your current costs. Actually in this scenario, a payday financial loan isn’t typically the greatest method to be in a position to obtain typically the help you want. You may use Albert Instant as de facto overdraft security too. Zero make a difference exactly how you employ it, there’s zero credit score verify — not necessarily also comfortable request — plus zero invisible costs regarding employ.

- Based on your transfer method, you may pay a payment associated with $1.99 – $2.99 each transfer.

- Normal money advance transactions through Dork can take up in order to 3 company days and nights.

- 2nd, an individual need to be in a position to have got at least $500 already inside your current lender accounts or Current accounts to qualify, plus 3rd, a person have to possess $500 within repeating debris.

This Particular costs $1 for each 30 days, which usually opens entry to become able to funds advancements plus some additional features. Sawzag asks for suggestions, yet these sorts of usually are recommended in inclusion to leaving behind a small idea or zero suggestion won’t influence exactly how very much a person could entry through ExtraCash. A Amount Of choices might become obtainable, but money advance apps plus individual loans are usually often finest when you want quickly cash. Here’s just what you want in order to know regarding how they will job in inclusion to when in order to think about them. Once the software supplier determines a person qualify with consider to a money advance, a person can usually request as much as an individual would like up to become in a position to your current authorized borrowing limit. Borrowing limitations are generally low at first nevertheless ought to enhance with exercise.

Cash Software doesn’t offer you loans where you get cash that will you may pay back again more than period. It does offer borrow cash app Pay out Above Time loans for purchases made via Cash App. Nevertheless, this specific feature doesn’t seem in order to end upward being obtainable to end upward being capable to all users.

- In Purchase To access advances, you’ll need to be in a position to indication up regarding Brigit’s As well as or Superior program.

- In Order To make use of Dork with regard to money improvements you may send to Money Software or some other accounts, you’ll want in order to pay a month-to-month regular membership fee (though typically the precise expense isn’t disclosed).

- A funds advance will be a purchase of which permits you to become capable to get funds coming from a lender in advance associated with future newly arriving money.

- In exchange, you concur to help to make payments, including virtually any costs or fees, and an individual acknowledge all phrases and conditions contained inside this specific Arrangement.

Even Though Current will be not necessarily a financial institution, it lovers with Choice Financial Team in order to offer banking providers. Via the cooperation together with City Commercial Lender, Current customers may link their own company accounts along with Zelle. It’s a bit indirect, yet this set up enables Present members to become able to deliver and get cash applying Zelle. In addition, Present gives a function similar to be able to a traditional cost savings bank account, which allows a person to become in a position to separate your own financial savings directly into 3 Savings Pods. Each And Every pod gets up to end upwards being capable to some.00% bonus cash (but along with very much fine print). An Individual could likewise employ Present in buy to invest, but simply inside cryptocurrency, and to end up being in a position to obtain a great interest-free payday advance associated with upward in buy to $750.

Not All Funds Advance Apps Connect Together With Go2bank — Right Here Are Usually The Best Ones That Will Do

Upon leading of that, Dork consists of useful equipment to end upwards being capable to aid a person manage your finances plus actually a round-up function in buy to help you help save automatically. Cash advance applications give you entry in buy to funds just before your payday, offering a more affordable alternate in order to conventional financial institution overdraft services, which usually appear with high charges. As An Alternative of relying on high-interest loans, these sorts of programs use non-reflex ideas or flat costs like a revenue source. These Types Of apps permit a person to obtain an advance about your current income, transfer the particular money to your own Cash App account, plus devote these people as required. Nevertheless does Money Application actually work with popular salary advance programs such as Brigit, Cleo, Earnin, Klover, plus Dave?

This goes upwards to a $40 payment whenever you advance $500, which may become pricey compared to some other funds advance applications. Klover is a mobile application that provides small funds advances in trade regarding users’ data that it stocks along with its advertising and marketing plus company companions. The Particular software provides advancements centered upon users’ financial institution account exercise, but consumers could likewise consider surveys, publish invoices in add-on to hook up store accounts to end upward being able to obtain an advance. Whenever choosing an app, believe regarding just what characteristics line up together with your economic requirements. Regardless Of Whether it’s higher advance limitations, lower fees, or added benefits just like earlier direct build up, obtaining the proper suit could help to make handling your finances much easier. Encourage offers quick cash advancements together with no late fees, even though it needs a month-to-month registration.

Early primary down payment is a great early downpayment associated with your whole salary. It comes closer to your pay time compared to a salary advance could — generally a couple of enterprise times early and no a whole lot more compared to several. A salary advance is not really technically a loan due to the fact it doesn’t charge curiosity.