Accounts Payable Turnover Ratio: Definition, Formula, and Examples

The cash conversion cycle spans the time in days from purchasing goods to selling them and then collecting the accounts receivable from customers. The DPO should reasonably relate to average credit payment terms stated in the number of days until the payment is due and any discount rate offered for early payment. In this guide, we will discuss what the AP turnover ratio is, why it matters, and how to calculate it. Our list of the best small business accounting software can help you find the solution that fits your needs. A low ratio may indicate issues with collection practices, credit terms, or customer financial health. Automation can speed up your AP process, as well as keep you up-to-date on payments, due dates, and a centralized place for all your bills.

How to Automate Accounts Payable Efficiently with Cflow

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. See our overall favorites, or choose a specific type of software to find the best options for you.

How Can You Improve Your Accounts Payable Turnover Ratio in Days?

Conversely, a lower ratio might point to cash flow issues or delays in paying suppliers. So, it’s time to upgrade if you don’t use accounting software like QuickBooks Online. It allows you to keep track of all of your income and expenses for your business. You can also run several reports that will help you not only calculate your A/P and A/R turnover ratios but also analyze cash flow and profitability. An increasing A/P turnover ratio indicates that a company is paying off suppliers at a faster rate than in previous periods, which also means that the number of days payables are outstanding is less.

How to analyze and improve your AP turnover ratio

These solutions can automate manual repetitive tasks and streamline the process making it easier to handle the heavy workload. Automation also improves accuracy and maintains consistency in processing account payable transactions. Here are a quick, easy answers to some of the most commonly asked questions about accounts payable turnover ratios. Accounts payable turnover ratio is just another way of saying accounts payable turnover. You can calculate your average accounts payable balance by adding your starting AP balance to your ending AP balance in the time period you’re working with and dividing that sum by two.

BlogAccounting Automation Blog

This shows that having a high or low AP turnover ratio doesn’t always mean your turnover ratio is good or bad. Below 6 indicates a low AP turnover ratio, and might show you’re not generating enough revenue. Alternatively, a lower ratio could also show you’ve been able to negotiate favourable payment terms — a positive situation for your company. Consider seeking feedback from career advisors, mentors, or professionals in your industry to improve your resume further.

Are There Drawbacks to the AP Turnover Ratio?

When assessing your turnover ratio, keep in mind that a “normal” turnover ratio varies by industry. That, in turn, may motivate them to look more closely at whether Company B has been managing its cash flow as effectively as possible. Dedicated and detail-focused individual seeking an entry-level Accounts Payable opportunity. Eager to apply strong organizational skills and a passion for finance in a professional setting.

Determine whether your cash flow management policies and financing allow your company to pursue growth opportunities when justified. Over time, your business can respond to new business opportunities and changing economic conditions. Improve cash flow management and forecast your business financing needs to achieve the optimal accounts payable turnover ratio. Your company’s accounts payable software can automatically generate reports with total credit purchases for all suppliers during your selected period of time.

- The AP turnover ratio is one of the best financial ratios for assessing a company’s ability to pay its trade credit accounts at the optimal point in time and manage cash flow.

- The advanced capabilities help companies to monitor and analyze key financial metrics in real-time.

- Focuses on the management of a company’s liabilities and its ability to pay its suppliers on time.

- Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable.

The following two sections refer to increasing or lowering the AP turnover ratio, not DPO (which is the opposite). Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. When she’s not what is a business contingency plan writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Let’s consider a practical example to understand the calculation of the AP turnover ratio. You may check out our A/P best practices article to learn how you can efficiently manage payables and stay fairly liquid.

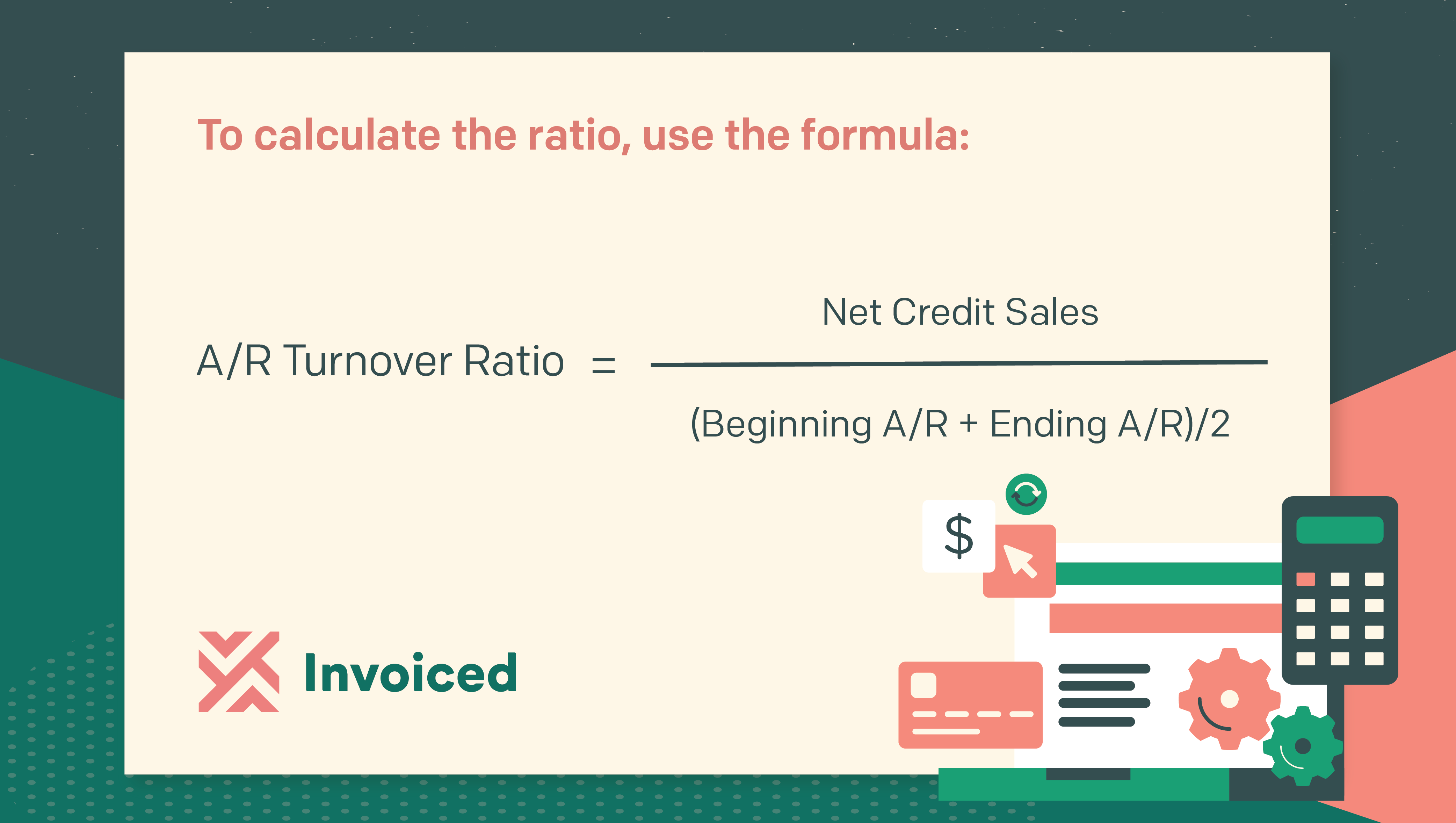

Overall, it is beneficial to analyze these two ratios together when conducting financial analysis. Accounts receivable turnover ratio is another accounting measure used to assess financial health. Accounts receivable (AR) turnover ratio simply measures the effectiveness in collecting money from customers.

Automated AP systems can easily identify opportunities for early payment discounts. Companies can leverage these discounts to reduce costs and improve their AP turnover ratio by paying quickly and more efficiently. With little cash, it would be impossible to pay suppliers quickly, which would then result in a low A/P turnover.

Since the accounts payable turnover ratio is used to measure short-term liquidity, in most cases, the higher the ratio, the better the financial condition the company is in. Businesses with a higher ratio for AP turnover have sufficient cash flow and working capital liquidity to pay their suppliers reasonably on time. They can take advantage of early payment discounts offered by their vendors when there’s a cost-benefit. Suppliers are more likely to offer favorable terms and discounts to companies that consistently pay on time, which can positively impact the AP turnover ratio. The AP turnover ratio is crucial for assessing a company’s ability to meet short-term liabilities. Typically, a higher ratio indicates better liquidity, suggesting efficiency in clearing dues to suppliers.